KEEP THE JEFFERSON UTILITY COMMISSION

VOTE NO ON THE APRIL 3 CITY OF JEFFERSON REFERENDUM

The April 3 ballot in the City of Jefferson has a referendum question asking if you approve of the City Council abolishing the Water and Electric Commission and transferring supervision of the Utility Manager to the City Administrator. For the reasons set forth below, I believe you should VOTE NO.

For the record, my name is Phil Ristow. I have lived in Jefferson for 37 years. I was Jefferson City Attorney for 11 years and Jefferson County’s Corporation Counsel for 24 more. During my time as City Attorney, the Utilities expanded by adding a well and converting the electrical service to 138KV to take advantage of cheaper electricity which advantage still exists today. I am now a member of the Utility Commission, appointed in 2015.

BACKGROUND

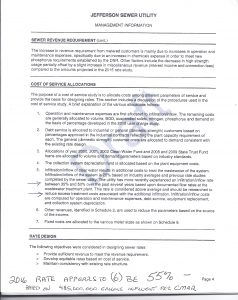

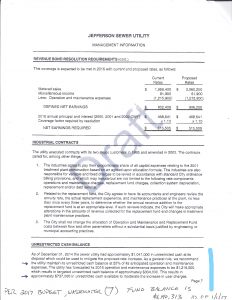

In May, 2016, the City Administrator lined up a no-bid handpicked consultant to do an 8-10 week analysis to identify possible “efficiencies”that might be gained in the city’s utilities, Water and Electric supervised by a citizen Commission, and the Wastewater utility managed by the Administrator and the Council. (The Stormwater utility is primarily a process set up to charge property owners fees for costs formerly paid with tax dollars.) After well over a year, the final report made a number of recommendations, some of which were no-brainers like doing a citywide infrastructure survey, some of which were unsupported conclusions and others that left many questions unanswered. Unfortunately, based on the superficial nature of the review, it appears quite possible that overall costs may actually increase if all of the recommendations are adopted as the “savings” consist of leaving vacant positions vacant with no actual reductions in cost at this time. There has been no accounting for probable pay increases. And, there are no savings from eliminating the unpaid Commission. While there is more discussion of the study below, it is important to note that the study DOES NOT recommend abolishing the Commission operating the Water and Electric utilities. The last recommendation in the study is to establish a Charter for the Commission, not eliminate it. Before any significant changes are actually considered, numerous questions should be answered based on accurate and real data (with no preconceived outcomes). More on that later.

UTILITY BILLS ARE NOT SUPPOSED TO BE A SECOND TAX BILL

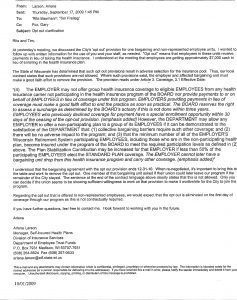

State law limits the amount that the city can raise property tax bills from one year to the next. When a city wants to spend more and it runs up against a legal tax cap, where else can it look for money? Often, like the creation of the Stormwater Utility, efforts are made to use utility bills as a kind of a second, substitute tax bill. The City Administrator calls the utilities “profit centers” so if the Commission is abolished, there will be no independent citizen group to protect the water and electric utility revenues from being used in “creative” ways to pay regular city expenses or to ensure that proper investments are made every year to maintain the infrastructure. For example, there was a reported plan to take $250,000 from the utilities for the second half of the payments for the ill-fated Osteopathic College study. And there has been some “creative” administration in recent years, some of which has generated significant payments directly into the Administrator’s pocket. Could there be a pay increase for the Administrator if the Commission goes away? More on that below.

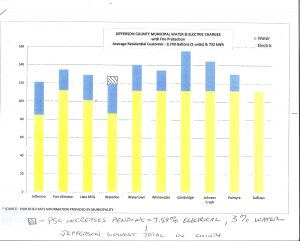

Your utility bill has a number of line items. Water and electric charges are established by the State of Wisconsin Public Service Commission. The rest of the items on your bill including sewer charges are determined by the Council. Services once funded by property taxes that have been “transitioned” to the utility bill over the years include public fire protection, refuse/recycling, and stormwater control. The tax dollars “saved” can then be spent on other things. The most recent example is a year ago when leaf removal was added to the utility bill as part of refuse and recycling. In the words of the City Administrator, it was “transitioned off the property tax rolls to monthly utility bills”. The Legislature has caught on to this method of evading the property tax levy cap and has enacted new law requiring a city to reduce its levy if it moves certain services to utility bills. With the big loophole closed, one new trick will be to “allocate” costs paid by property tax levy to utility bills.

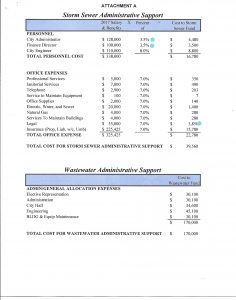

The Stormwater Utility is a place to allocate costs that used to be tax funded. For one, the City Administrator is charged to this account at the rate of 1.4 hours per week. (How realistic is this allocation when he didn’t regularly attend the Utility Commission meetings covering its $13 million operation for perhaps 1.4 hours in a month?) The Storm Water administration charge of $39,560 covers two projects totaling $115,000 in 2018. The Wastewater administration bill for $170,000 is also built into the sewer charge on your utility bill. Per the City Administrator on page 8 of his 2018 budget message, the amount “is completely arbitrary and is established annually by the City”.

How many current city expenses will be (arbitrarily?) allocated to the Water and Electric bills if there is no Commission around to stop it? If each utility gets an Administration allocation like the Stormwater Utility, $80,000 will be “transitioned off the property tax rolls to the monthly utility bills”. That would eat up a good chunk of the paper “savings”that are supposed to occur from not filling vacant positions. (And, the study failed to actually analyze which vacant positions might actually be needed!) If the Commission is abolished, who will keep city allocations or arbitrary charges off your water or electric bill? Can you rely on an administration that looks at the utilities as “profit centers”?

WHILE WE’RE AT IT, A COUPLE MORE BUDGET QUESTIONS

At its April 5, 2017 meeting, the Council took $150,000 from the Stormwater Utility to fund implementation of the Branding Study and Harry Potter expenses. After emailing the Finance Director that by city code, Stormwater funds can only be used for Stormwater purposes, the Administrator stated that the money was “to repay an advance from the General Fund to the Stormwater fund from a few years ago”. If the money belonged to the General fund, why wasn’t it in there when the tax levy was calculated over the intervening years? How much other money is floating around, or stashed in other funds that could be used to lower the tax rate if it was pointed out to the public and the Council?

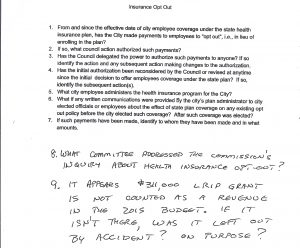

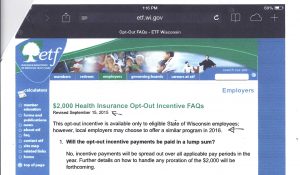

Another interesting budget maneuver has come to light during review of City budgeting practices. Back in September, 2017, written questions were submitted to the Council about a couple of situations. One had to do with $311,500 of grant revenue missing from the 2015 budget. Section 65.90 of the Wisconsin Statutes requires the city when developing its budget to “list all . . . anticipated revenues . . .” for the purpose of giving notice to the public (and the Council) of the financial assets available to reduce the amount of taxes needed to be raised. The City Administrator prepares the budget. The question presented to the Council in September was whether the revenue was accidentally overlooked, or left out on purpose. Section 68-4 C (2)(p) of the city code directs the City Administrator to establish communication procedures for citizen questions to get prompt attention and be expeditiously resolved. There has been no effort to answer the question even though it was asked again in November. The Council should ask the Administrator to review his emails from September, 2014, and advise the Council and the public as to why the funds were not budgeted as a revenue. At the end of the year, did an unexpected $300,000 surplus lead to a good evaluation and a nice bonus for the Administrator? Are such legal budget rules ignored frequently?

Had the Council been advised of the additional $311,500 anticipated revenue, it could have decided to use it to lower taxes. If used to reduce taxes, the tax bill on a $150,000 property would have been about $100 lower.

The Water and Electric Utility budget is about $13,000,000. The City budget is about $12,000,000. Are you ready to make the Utility cash flow easily accessible for more “allocations” or “creative” uses? Keep the Commission on the job to keep rates reasonable and make sure the money you pay is used for regular infrastructure investments for the long term health of your utilities and nothing else.